Commbank Term Deposit

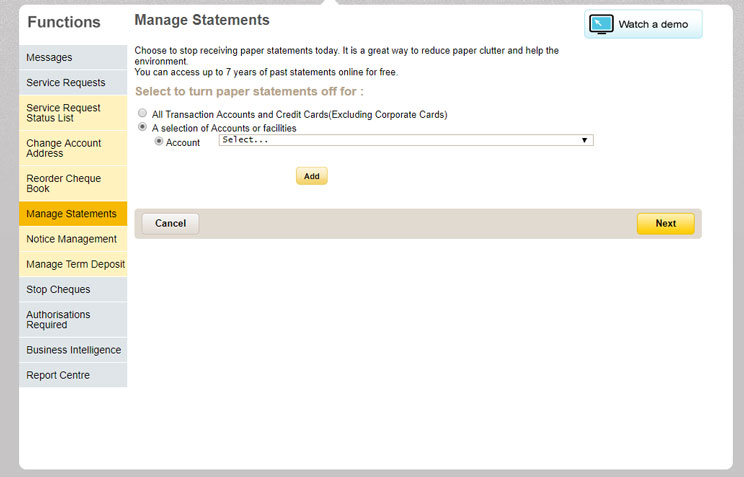

I love Commonwealth Bank, the staff are helpful, and I like that they were happy to match other bank's rates on the term deposit if you ask. You can view the rates online so you can compare with other banks, and when it matures they send you a letter so you don't forget about it and you can renew it over the phone instead of going into the branch. A step by step guide to managing your Term Deposit maturity in NetBank. Get more tips about using NetBank at commbank.com.au/netbank.

Term Deposit is a product for individual and corporate that can support the growth of your savings

Term Deposits Commbank 13/09/2019

Benefits:

| - | Available in a wide selection of currencies (IDR/AUD/USD). |

| - | Affordable minimum initial deposit. |

| - | Competitive interest rate. |

| - | Convenience in transaction through Internet/Mobile Banking with discount for transaction fee including: |

| - | Term Deposit Advice as a confirmation of placement, renewal, maturity / termination of the Term Deposit. |

Easy Time Deposit (TD) Transactions through Phone Indemnity / POI and Enjoy the Benefits:

- Ease of doing transaction anywhere without coming to branch.

- Customer is not required to sign any form. Customer is only required to confirm the transaction by Phone with our Relationship Manager (RM).

- Faster transaction processing and Time Efficient.

Deposit transaction options include: Time Deposit Placement, Time Deposit Prepayment and Time Deposit Termination.

Risk of Product

One of the risks attached in Term Deposit product is the changes in fees that can be done at anytime and it will be informed to customers through branches, website or other media deemed appropriate by the Bank.

Procedures and Requirements

Opening a Term Deposit can be done at the nearest Commonwealth Bank branch by completing and signing the account opening application form and providing the required documents or through Internet Banking (for existing customers).

Document Requirement:

| Resident | : | Valid ID (KTP) |

| Non Resident | : | Passport; and KIMS/KITAS/Reference letter from company/Reference Letter from Commonwealth Bank of Australia (CBA) |

| Institution | : | Documents requirement according to Terms and Conditions applied by Commonwealth Bank |

| Description | Fee |

| Initial deposit | IDR 50,000,000 or AUD/USD 5,000 |

| Break fee (if break before time to maturity) | 0,5% from Principal, interest is not paid.** |

*Fees and Charges is subject to change and it will be informed to customers through media deemed appropriate by the Bank.

**Early Break Time Deposit before maturity, the ongoing interest paid will be deducted from the principal

Commbank Term Deposit Rates Pdf

Interest Rate Calculation

Interest is calculated based on end of day balance according to the prevailing interest rate. Interest rate table can be access in here

Product Expiration

The expiry of the product will be when customer or Bank closes the account.

Product Issuer

This Product issued by PT Bank Commonwealth and guaranteed by Indonesia Deposit Insurance Cooperation/Lembaga Penjamin Simpanan ('LPS')***

***If the value of total deposit exceeds maximum value/if the interest rate of deposit exceeds interest rate of Indonesia Deposit Insurance Cooperation/Lembaga Penjamin Simpanan ('LPS'), deposit is not included and/or shall not be guaranteed by LPS in Deposit Insurance Scheme/Program Penjaminan Simpanan.